Al Jobran Insights

Exploring a World of News and Information

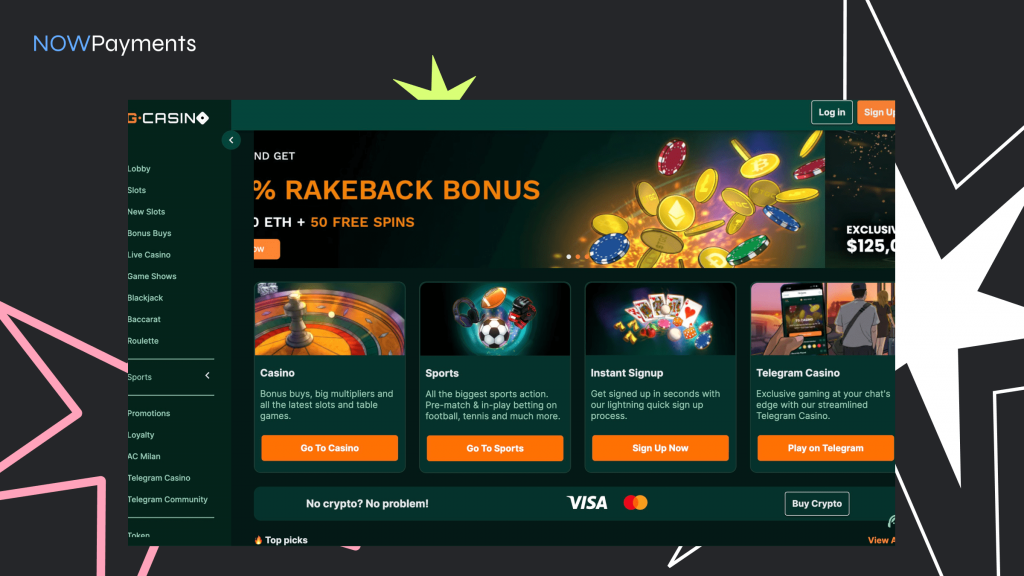

Betting on Pixels: Exploring Innovative Crypto Item Models

Dive into the world of crypto items and discover innovative models that could change the game! Bet on pixels and unlock your digital fortune!

Understanding the Evolution of Crypto Item Models in Gaming

The world of gaming has undergone a significant transformation with the rise of cryptocurrency and blockchain technology. Understanding the evolution of crypto item models in gaming is essential for gamers, developers, and investors alike. Traditionally, in-game items were confined to their respective platforms and games, leading to limitations in ownership and trading. However, with the introduction of non-fungible tokens (NFTs), players can now truly own their digital assets. This ownership is facilitated by blockchain technology, enabling seamless transfers and sales across different platforms, thus enhancing the gaming experience.

As various game developers begin to embrace this shift, we see a variety of crypto item models emerging. From collectible card games that utilize NFTs to massive multiplayer online games (MMOs) allowing players to trade unique items securely, the landscape is continuously evolving. A notable example is the rise of play-to-earn models, which empower gamers to earn cryptocurrency through gameplay, thereby turning entertainment into a potential source of income. As this sector matures, it is essential to keep track of these changes and how they might shape the future of not only gaming but also broader economies.

Counter-Strike is a popular first-person shooter game that pits teams of terrorists against counter-terrorists in a strategic battle. Players can enhance their gaming experience by utilizing a csgoroll promo code for additional bonuses and perks. The game's competitive nature and community-driven environment have made it a staple in esports.

How to Identify Value in Digital Assets: A Guide to Crypto Items

Identifying value in digital assets, particularly crypto items, requires a combination of understanding the underlying technology and market factors. Begin by examining the blockchain technology that underpins each asset, as this can provide insights into its security and utility. In addition, consider supply and demand dynamics; assets with limited supply and high demand often hold greater value. Utilize tools like price tracking websites and social media sentiment analysis to gauge current market trends and investor interest in specific crypto items.

Another critical aspect of assessing the value of crypto items is the evaluation of their use cases. For instance, some cryptocurrencies are designed for specific functions such as smart contracts or decentralized finance (DeFi), which can enhance their utility and, consequently, their value. Additionally, keep an eye out for community engagement and development activities surrounding a crypto asset. Active communities and ongoing development can indicate a project’s viability and potential for future growth. Tracking these factors will help you make informed decisions when identifying valuable digital assets.

What Are the Risks and Rewards of Betting on Crypto Item Models?

Betting on crypto item models can offer a unique blend of risks and rewards. On one hand, the potential for high returns is significant due to the volatile nature of cryptocurrencies and digital assets. Investors who have the ability to navigate the market effectively may find opportunities to profit from price fluctuations. However, this volatility also entails a substantial risk of loss. The lack of regulation in the crypto space can lead to unforeseen issues, including fraud and market manipulation, making it essential for investors to conduct thorough research before diving into this arena.

Additionally, the rewards of betting on crypto item models extend beyond just financial gains. Early adopters often find themselves at the forefront of technological advancements and digital innovations. These individuals may also participate in lucrative community-driven ventures, such as decentralized finance (DeFi) projects or non-fungible tokens (NFTs). Nevertheless, it is crucial for investors to recognize the importance of risk management strategies and to diversify their portfolios to mitigate potential downsides. Ultimately, understanding the complexities of the market will be key to maximizing the rewards while minimizing the risks.