Al Jobran Insights

Exploring a World of News and Information

Cashback Chaos: How to Turn Losing Streaks into Winning Strategies

Unlock the secrets to transforming loss into gain! Discover winning strategies to conquer cashback chaos and boost your earnings today!

Maximizing Your Cashback: Tips for Finding the Best Deals

Maximizing your cashback requires a strategic approach to shopping and spending. Start by researching cashback programs that align with your spending habits. Many major credit cards, shopping apps, and websites offer cashback rewards that can vary significantly. To ensure you're getting the best possible returns, compare offers from different services, and don’t hesitate to switch programs if you find a better deal. Additionally, take advantage of seasonal promotions and limited-time offers, as these can often provide enhanced cashback opportunities.

Another effective strategy for finding the best deals is to plan your purchases around cashback events. For instance, some retailers offer double or triple cashback during holidays or special sales events. Consider joining loyalty programs that often provide exclusive cashback deals for members. Remember to also utilize price comparison tools to identify the best prices across various platforms before making a purchase. By combining cashback offers with strategic shopping habits, you can significantly boost your rewards and maximize your savings.

Counter-Strike is a popular team-based first-person shooter game that has captivated gamers worldwide. Players can choose to fight as terrorists or counter-terrorists in various game modes, showcasing their skills in strategy and teamwork. If you're looking to enhance your gaming experience, consider checking out the shuffle promo code for some exciting offers.

The Psychology of Cashback: Why You Keep Losing and How to Win

The allure of cashback programs often tempts consumers into a cycle of spending that can lead to financial pitfalls. This phenomenon, known as the psychology of cashback, taps into the deep-seated human desire for instant gratification. When shoppers see a cashback offer, they might feel encouraged to buy products they don't need, under the illusion that they're saving money. However, research indicates that this behavior can result in overspending, ultimately negating the benefits of the cashback reward. To avoid falling into this trap, it's crucial to set strict spending limits and adhere to a budget that prioritizes your financial well-being.

To truly win with cashback offers, consumers must shift their mindset from a reactive to a proactive approach. This involves being strategic about purchases by maximizing cashback earnings on items you already plan to buy. Creating a list of essential items and sticking to it can help curb impulsive spending. Additionally, consider utilizing cashback apps or credit cards that offer higher returns for specific categories. By aligning cashback opportunities with your pre-planned expenses, you can harness the power of cashback without succumbing to its deceptive allure.

Is Cashback Worth It? A Deep Dive into the Benefits and Pitfalls

Is cashback worth it? This question often arises among consumers looking to maximize their savings through credit card rewards, specific shopping portals, and loyalty programs. The primary benefit of cashback is its simplicity—unlike points or miles that may require an intricate understanding of redemption options, cashback offers a straightforward return of your spending. For instance, a cashback credit card might provide 1% to 5% back on purchases, making it an appealing choice for regular buyers. Many consumers find that using cashback strategically can lead to significant savings over time, especially if they consistently pay off their balances to avoid interest charges.

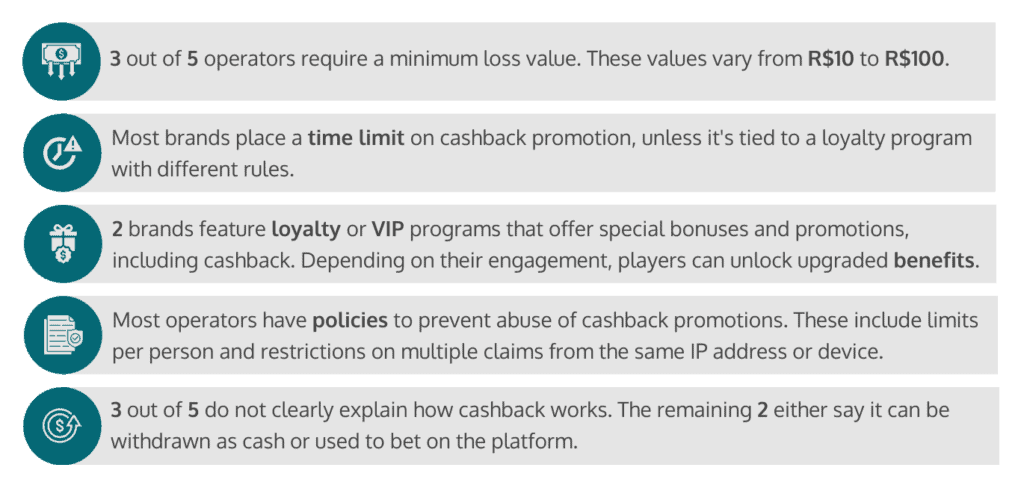

However, there are pitfalls to consider when pursuing cashback opportunities. First, some cashback programs come with restrictions, such as limits on certain categories or expiration dates on accrued rewards. Additionally, overspending to chase cashback can lead to debt accumulation, undermining the overall financial benefits. To truly ascertain if cashback is worthy for you, it’s essential to evaluate your spending habits, the terms of your cashback program, and whether the potential rewards outweigh any related costs. Ultimately, a well-informed approach towards cashback can enhance your financial efficiency, but one must remain cautious of the traps that can diminish its value.