Al Jobran Insights

Exploring a World of News and Information

Crypto Market Volatility: Riding the Rollercoaster of Digital Assets

Experience the thrill of crypto market volatility! Discover tips to navigate the wild ride of digital assets and maximize your gains.

Understanding Crypto Market Volatility: Key Factors Driving Price Fluctuations

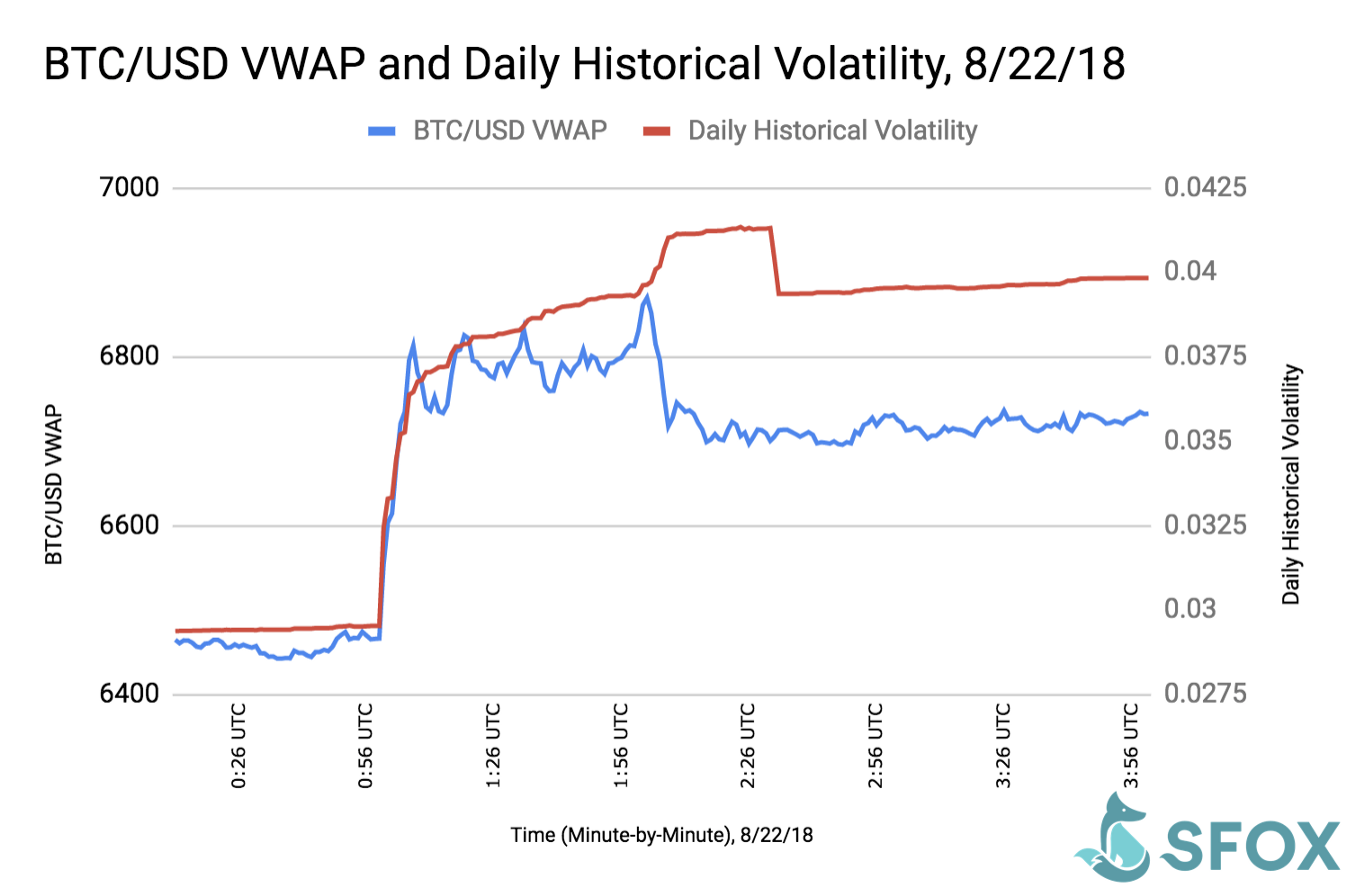

The cryptocurrency market is known for its volatility, which can lead to rapid price fluctuations that often leave investors and traders guessing. Several key factors contribute to this volatility, including market sentiment, regulatory news, technological advancements, and macroeconomic trends. For instance, market sentiment can shift drastically based on social media trends or statements from influential figures, creating sudden spikes or drops in prices. Additionally, regulatory announcements can either boost investor confidence or instill fear, further impacting market dynamics.

Another significant factor is the liquidity of cryptocurrencies. Compared to traditional financial markets, the crypto market has lower liquidity, meaning that large trades can cause substantial price movements. Supply and demand also play a critical role; when more investors enter the market, the demand for assets rises, leading to price increases. Conversely, when investors panic sell during market downturns, prices can plummet. It's essential for traders to understand these factors and monitor market indicators to navigate the uncertainties of crypto market volatility effectively.

Counter Strike is a popular team-based first-person shooter game that has captivated millions of players worldwide. It features intense tactical gameplay where players can choose between the terrorist and counter-terrorist teams. If you're looking for ways to enhance your gaming experience, consider using a cloudbet promo code to get some bonuses. The game's mechanics, combined with its competitive nature, have made it a staple in the esports community.

How to Manage Risk During Crypto Market Swings: Strategies for Investors

Managing risk in the volatile world of cryptocurrency is crucial for investors looking to preserve their capital during market swings. One effective strategy is to implement a diversification approach by spreading your investments across different cryptocurrencies and assets. This not only helps mitigate potential losses from a single asset but also provides opportunities to capitalize on various market movements. Additionally, establishing clear entry and exit points can help investors make informed decisions and avoid emotional trading, which often leads to unfavorable outcomes.

Another vital tactic for risk management is to employ stop-loss orders. These automated orders can limit losses by selling your assets when they fall below a certain price, effectively safeguarding your investment during market downturns. Furthermore, staying informed about market news and global economic factors is essential. Investors should regularly analyze trends and adjust their strategies as necessary. By combining these risk management techniques, investors can better navigate the unpredictable landscape of cryptocurrency trading.

What Causes the Wild Price Swings in Bitcoin and Other Cryptocurrencies?

The volatility in Bitcoin and other cryptocurrencies can be attributed to several key factors. Firstly, the market is influenced by speculation and investor sentiment. As a relatively new asset class, cryptocurrencies are subject to sudden price swings driven by news, social media trends, and market hype. For instance, a positive announcement regarding a major partnership can lead to a surge in prices, while regulatory news or hacks can prompt immediate sell-offs. This unpredictable investor behavior often results in significant price fluctuations over short periods.

Another primary cause of these wild price swings is the market structure itself. Unlike traditional financial markets, the cryptocurrency market operates 24/7 and lacks the liquidity of more established assets. This means that even small trades can have a large impact on prices. Additionally, the presence of large holders or 'whales' can exacerbate volatility; when these individuals decide to buy or sell substantial amounts, it can lead to drastic shifts in market prices. Understanding these dynamics is crucial for anyone looking to invest in or trade cryptocurrencies.